Consultation

+1 (954) 440-9980

Send a message.

We’re here to answer any question you may have.

Consultation

+1 (954) 440-9980

We’re here to answer any question you may have.

Made Simple

Invoice factoring is a fast way for businesses to turn unpaid invoices into immediate cash.

Instead of waiting 30–90 days for customers to pay, FactorFi gives you an advance on those invoices so you can keep your business running smoothly.

01

02

03

04

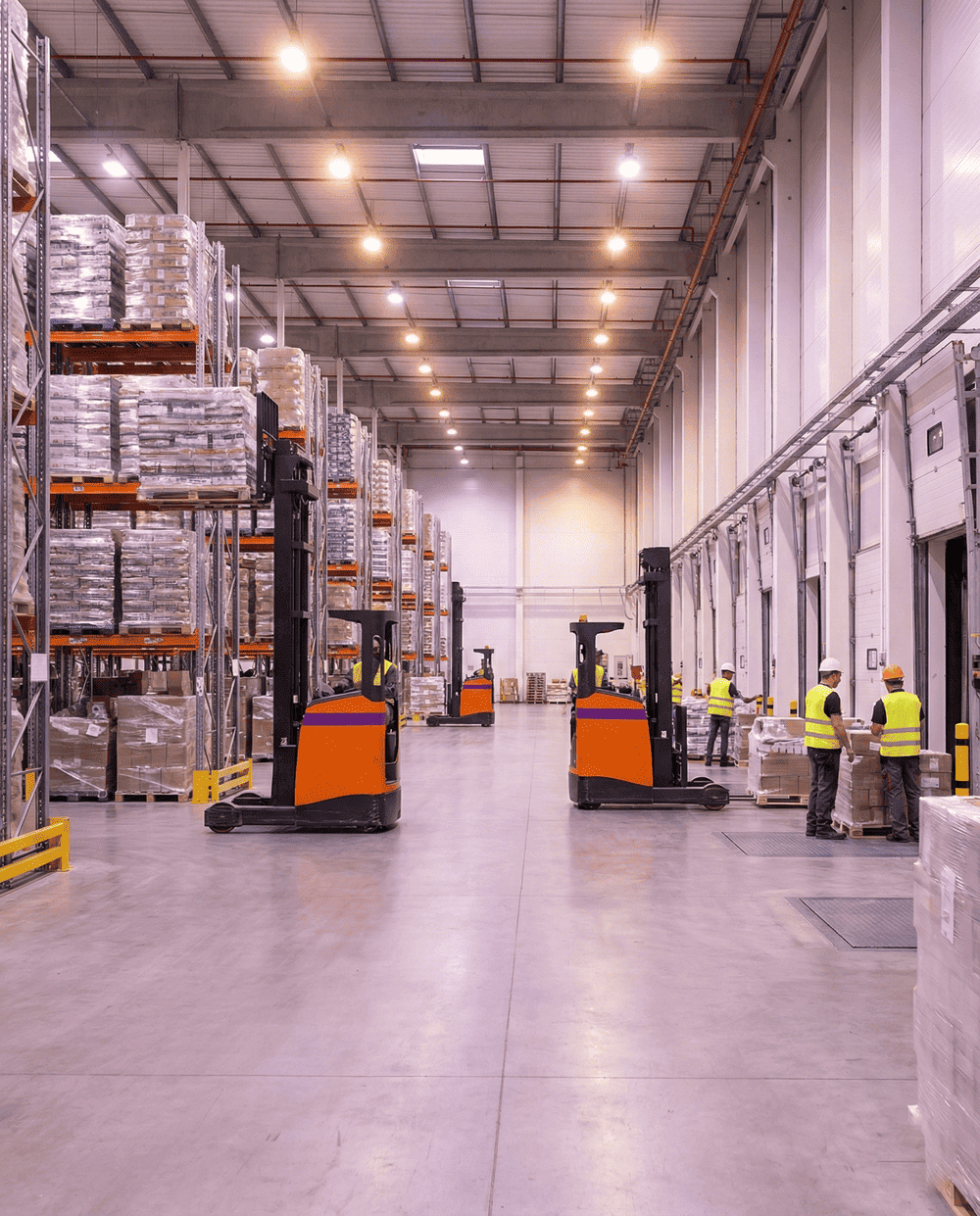

Invoice factoring is perfect for B2B companies that invoice clients on net-30, net-60, or net-90 terms.

Industries that commonly use it include:

Factoring fees as low as 0.90% depending on:

Getting approved with FactorFi is simple. You typically need:

Invoice factoring allows you to unlock the money already tied up in your receivables—so you can grow faster, take on more clients, and avoid cash-flow delays.

Adding {{itemName}} to cart

Added {{itemName}} to cart